how to determine unemployment tax refund

Use the line 8 instructions to determine the amount to include on Schedule 1 line 8. States assign your business a SUTA tax rate based on industry and history of former employees.

Enter the amount of the New York State refund you requested.

. Web If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax. Web Because you didnt know the exact refund amount youre going to receive when the unemployment compensation is factored in your federal income tax return. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Take a look at the base period where you received. Web Unemployment Insurance Tax. Choose the form you filed from the drop-down menu.

Work out your base period for calculating unemployment. Web Enter your Social Security number. Web Because you didnt know the exact refund amount youre going to receive when the unemployment compensation is factored in your federal income tax return.

Web To calculate your weekly benefits amount you should. Every employer in Tennessee is required to fill out a Report to Determine Status Application for Employer Number LB-0441. By filling in the relevant information you can estimate how large a.

Web Use our free online service to file wage reports pay unemployment taxes view your unemployment tax account information eg statement of account. Web Estimate your tax refund with HR Blocks free income tax calculator. Web This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form.

Web The Tax Withholding Estimator on IRSgov can help determine if taxpayers need to adjust their withholding consider additional tax payments or submit a new Form. Web Your SUTA tax rate falls somewhere in a state-determined range. Web Dont include any amount of unemployment compensation from Schedule 1 line 7 on this line.

Web The IRS said the third round of unemployment tax refunds going out this week will be sent to nearly 4 million taxpayers with an average refund of 1265. Web In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work.

Stimulus Unemployment Answers To Your Tax Related Questions Fox43 Com

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Irs Unemployment Refund Update How To Track And Check Its State As Usa

Unemployment Tax Refund Don T Waste Your Money Again

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Brproud Still Waiting On Your Unemployment Refund Irs To Send More Checks In July

How Unemployment Stimulus Payments Will Affect Your Taxes Whas11 Com

Irs Tax Refunds To Start In May For 10 200 Unemployment Tax Break Brinker Simpson

3 11 154 Unemployment Tax Returns Internal Revenue Service

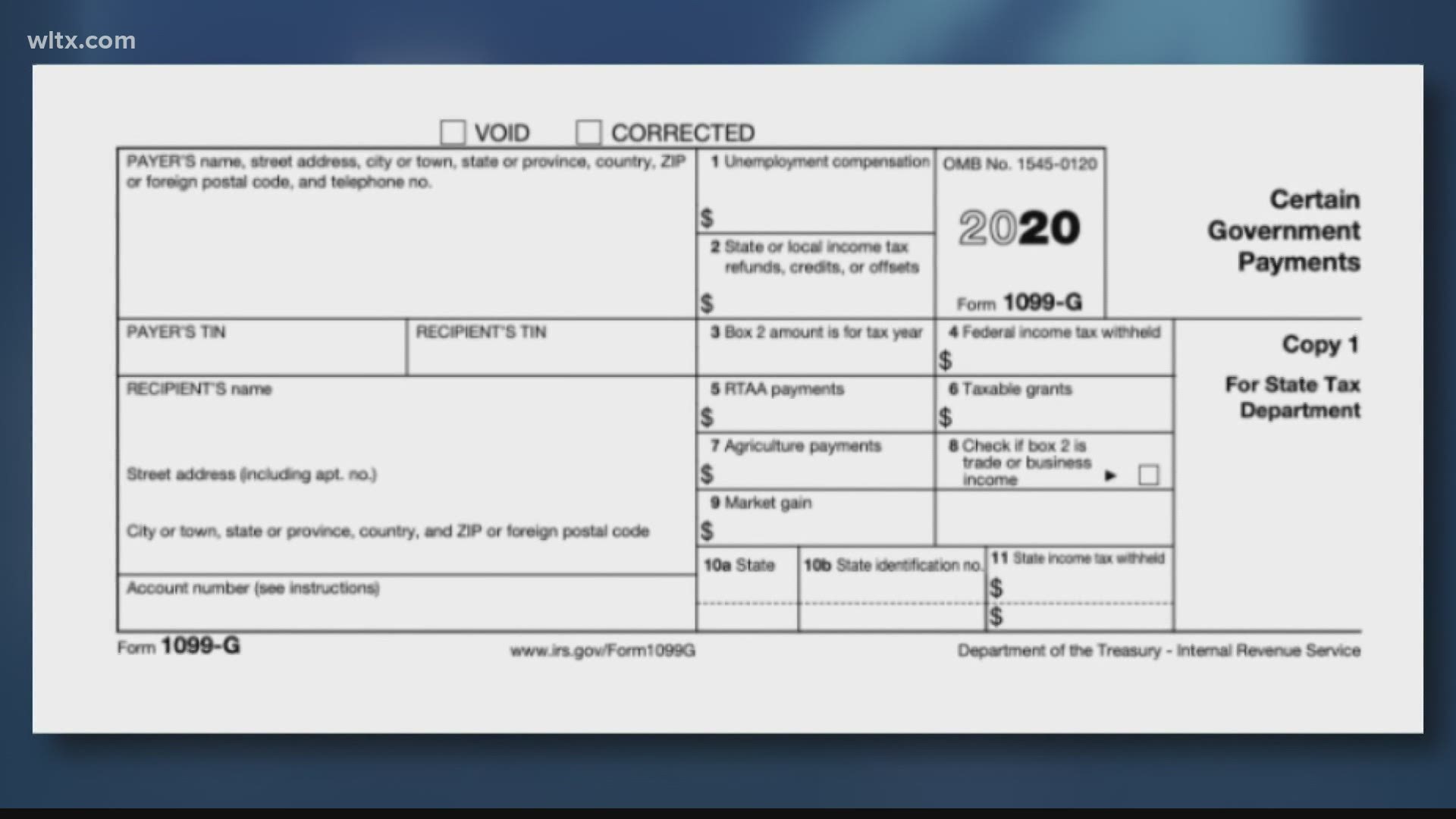

File For Unemployment Last Year Documents You Need To File Taxes Wltx Com

When Will Irs Send Unemployment Tax Refunds Weareiowa Com

What You Should Know About Unemployment Tax Refund

Unemployment Tax Refund Still Missing You Can Do A Status Check The National Interest

How To Calculate Unemployment Tax Futa Dummies

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break

How To Report Your Unemployment Benefits On Your Federal Tax Return Get It Back

Tax Refunds On Unemployment Benefits Still Delayed For Thousands